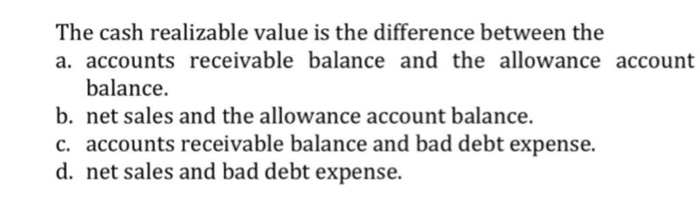

The Cash Realizable Value Is the Difference Between the

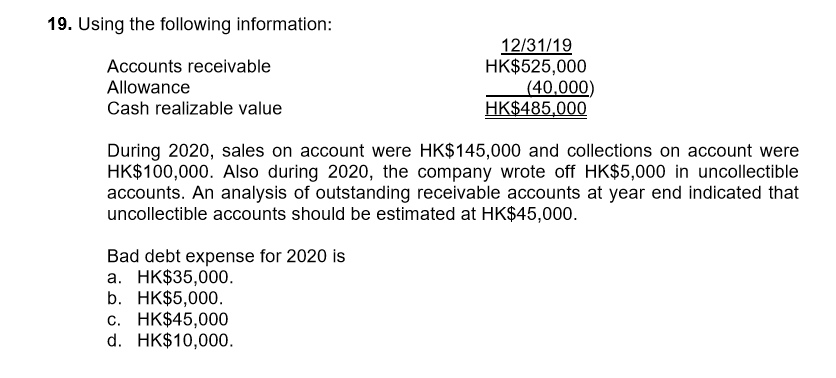

-better estimate of cash realizable value-management estimates what of credit sales will be uncollectible that is baed on past experience anticipated credit policy. The cash realizable value is the difference between the a.

Net Realizable Value Formula Simple Accounting Org

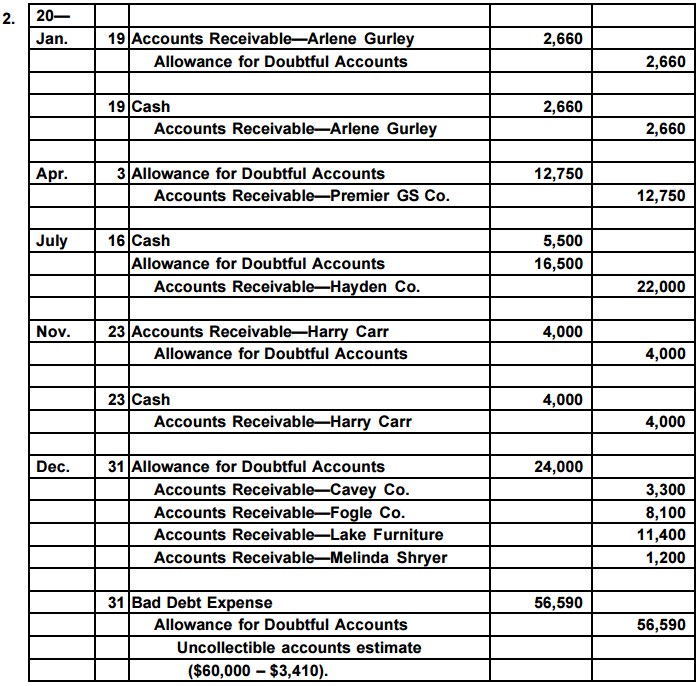

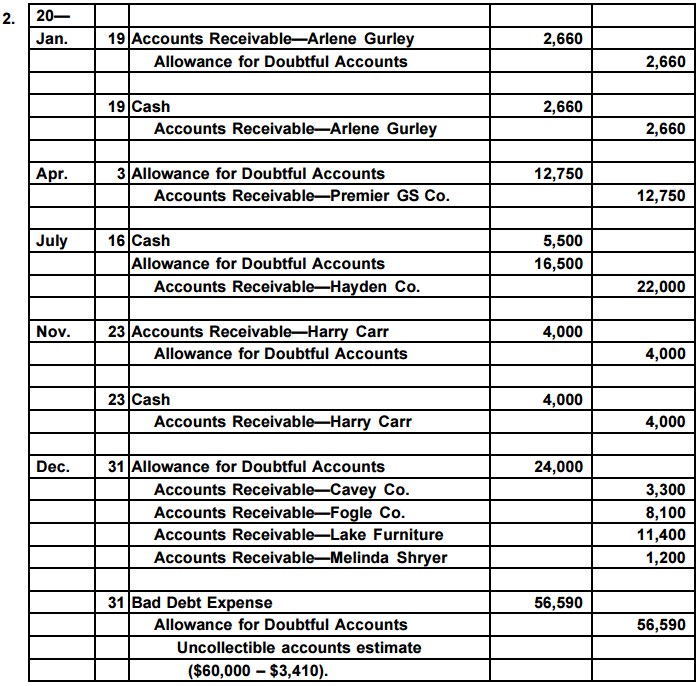

Allowance for Uncollectible Accounts.

. The net realizable value equals the dollar amount of accounts receivable minus the dollar amount of allowance for uncollectible accounts. Accounts receivable balance and bad debt expense. Examples of Lower of Cost or Market LCM In this example replacement cost falls between net realizable value and net realizable value minus a normal profit margin.

The cash realizable value is the difference between the a. Net sales and the allowance account balance. Net sales and the allowance account balance.

B the difference between accounts receivable and uncollectible-account expense. -the amounts of the bad debt adjusting entry is the difference between the required balance and the existing balance in the allowance account. All the related cost like disposal cost transportation cost etc.

Why is a product that sells for 50 reported in inventory at its cost of 40. The net realizable value of accounts receivable is the difference between gross accounts receivable and. Calculate the difference between the market value expected selling price of an asset and the costs associated with the completion and sale of an asset.

What is net realizable value. See net realizable value. Net realizable value NRV is the value of an asset which can be realized when that asset is sold.

Net sales and the allowance account balance. Subtract the selling costs from the market value to arrive at the net realizable value. The net realizable value of accounts receivable is the difference between gross accounts receivable and.

Accounts receivable balance and the allowance account balance. Accounting questions and answers. Realized income is that which is earned.

Net realizable value NRV is the value of an asset that can be realized upon the sale of the asset less a reasonable estimate of the costs associated with either the. If a company ships out goods worth 10000 and includes an invoice for those goods with 30-day terms the company doesnt recognize the 10000 in income until it has a check in hand for that amount. Net Realizable Value - NRV.

The net realizable value of accounts receivable is. The cash realizable value is the difference between the accounts receivable balance and the allowance account balance. Net sales and the allowance account balance.

2 QUE Concord Company provides for bad debt expense at the rate of 3 of accounts receivable. What to do with the balance in Allowance for Doubtful Accounts. The cash realizable value is the difference between the accounts receivable balance and the allowance account balance.

Net Realizable Value inflow of cash from Sale of Asset expense incurred. Accounts receivable balance and bad debt expense. Mathematically the net realizable value can be found through the following equation.

Net sales and bad debt expense. It is a net realizable value of an asset. Net sales and bad debt expense.

Noona Corporation files for Chapter 7 bankruptcy when the book value of its net land and building is 80000 and these assets have a fair value similar to their estimated realizable value of 40000. NRV is part of GAAP rules that apply to valuing inventory so as to not overstate or understate the value of inventory goods. Allowance for Uncollectible Accounts The Allowance for Uncollectible Accounts is.

The cash realizable value is the difference between the accounts receivable balance and the allowance account balance. It is also termed as cash Realizable value since it is the cash amount which one gets for the asset. The cash realizable value or net realizable value of a companys accounts receivable is the amount the company expects to receive in cash as payment from customers.

Sales Returns and Allowances. Cash realizable value definition. Marks Net realizable value The difference between gross receivables and the from RSM 219 at University of Toronto.

Net sales and the allowance account balance. Accounts receivable balance and. Which concept is an example of lower of cost or market value.

It is also learned that inventory items with an. What is the difference between realized income and recognized income. Should be subtracted while calculating a net realizable value.

C the amount of accounts receivable that the company expects to. Net realizable value is a commonly used method of evaluating an assets worth in the field of inventory accounting. Accounts receivable balance and the allowance account balance.

A the difference between accounts receivable and its contra asset account.

Solved The Cash Realizable Value Is The Difference Between Chegg Com

How To Determine The Cash Realizable Value In Accounting Personal Accounting

9 1 Accounting For Receivables 9 Learning Objectives Explain How Companies Recognize Accounts Receivable Describe How Companies Value Accounts Receivable Ppt Download

No comments for "The Cash Realizable Value Is the Difference Between the"

Post a Comment